Set your Bounce-Back Portfolio Strategy

Marvin V. Fausto

President, COL Investment Management

Key Points

The pandemic has affected the returns in the stock market making investors discouraged, disappointed, with many resulting to inaction. Not losing sight of the big picture can help you bounce-back and jumpstart your investment journey. Get the Big Picture As we learned from our past, stock market returns are much better after every major crisis. Jumpstart your Investment Journey Review your allocation, realign to a more comfortable weight in resilient sectors, and restart through the discipline of regular investing in a diversified portfolio to successfully reach your goals.

After some wild swings, the stock market stayed in bear market territory with a decline of more than 20% this year. Many have experienced substantial drops in their stock portfolio depending on the extent of their exposure. It is quite understandable that with bad returns, many will be disappointed and be discouraged. After saving their hard-earned money and believing that the stock market is the best place to put their money, one can really lose confidence. With the way the market has performed lately, building wealth seemed to be getting more difficult. Many struggles and even fell into inaction, making it hard to bounce back.

Looking at The Big Picture

If one were to look at the bigger picture, however, and see the historical performance for the past four decades, the situation paints a more encouraging picture.

Table 1 shows that in all instances, when the stock market dropped by more than 20% for the year -- the definition of a bear market -- the succeeding 10 years compounded annual growth rate (CAGR) all generated positive returns and even averaged 16.4%.

This happened right after a major crisis. For instance, ten years after the Economic Crisis in ‘84, Power Crisis in ’90, Asian Financial Crisis in ’97, Political Crisis (Edsa II Revolution) in 2000, and the Global Financial Crisis in 2008, stock market returns generated strong returns.

TABLE 1: 10-year CAGR after the Stock Market declined more than 20%

Source: Bloomberg; COL Estimates. Compounded Annual Growth Rate (CAGR)

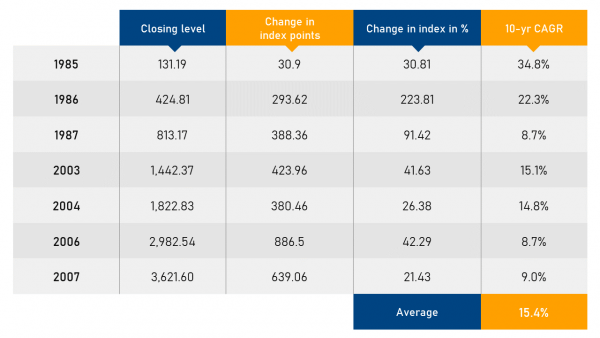

More so, even after strong markets where performance is well above 20% as shown in Table 2, the succeeding 10 years CAGR generated still a decent 15.4% average return.

TABLE 2: 10-year CAGR after the Stock Market increased by more than 20%

Source: Bloomberg; COL Estimates. Compounded Annual Growth Rate (CAGR)

Indeed, even in times like today when the economy is weak, looking at the bigger picture will appease one’s concerns and make you realize that times like these clearly present such a great investing opportunity.

Jumpstart Your Investment Journey

Jumpstart your investment journey by building a bounce-back strategy by reviewing, realigning and restarting your portfolio.

Review:

It starts with a quick review of your allocation and understand how you reacted to the recent downturn. The magnitude of the swing in market value will depend on how heavy you are exposed in the stock market relative to your fixed income portfolio --the heavier the exposure, the wider the swing.

Realign:

Adjust your allocation to a more comfortable weight but stay true to the objective of the investment. Fixed income investment is more stable but with lower returns, while stock investment is volatile but geared for higher returns.

The crisis has resulted in difficult challenges to businesses requiring a major shift in strategies and realignment of efforts to address the new way of doing things. Take advantage of the opportunity and invest in the market by having a core strategy centered in an equity index fund. By doing so, you easily get to participate in the anticipated recovery. After which you can complement your allocation in different sectors that are focused on the more resilient industries that will not only survive this crisis but will also thrive in the coming years.

The new normal sector like the telecom industry, for instance, has shown resilience and even strong potential for growth with the greater demand for more bandwidth. The essential consumer producers and distributors like food manufacturers and groceries will remain robust and generate sustainable growth. Utilities and power companies will be indispensable and will be critical especially when the economy bounces back. These are just some of the opportunities at this season that should not be ignored.

Restart:

Finally, restart your investment engine and program your purchases in a regular and even automatic way so you don’t lose sight of the bigger picture. Let not your emotions affect your decisions and keep track of your plans. Focus on your long-term goals and start implementing your strategy.

I am often asked when is the best time to invest in the market. And if I were to answer that – The best time to invest is when the market is down, not when it is up. This kind of opportunity only visits us occasionally, so muster the energy to bounce back and rekindle your journey towards financial success.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.