Different stock investing strategies through Equity Funds

Mark Ilao

Head of COL Fund Source

Key Points

- Equity funds can be an effective way to invest in stocks without having to do complex analysis on companies. They come in many different forms, allowing you to invest in stocks in a way most suited to your objectives. - Growth Funds which focus on companies with potential high growth. - Dividend Funds which invest in stocks that pay regular dividends. - Thematic Funds which let you invest in sectors, for example consumer sector - Index Funds that track a particular market index, like the PSE Index.

When people think of investing in stocks, often the only way that comes to mind is to buy stocks of companies individually. For example, you buy ALI, or SM, or JFC.

However, do you know that there are other strategies you can employ when investing in stocks – and you can do these different strategies through Equity Funds.

Equity funds—also known as stock funds— can be an effective way to have stocks without having to do complex analysis on companies to be able to select which individual stocks to buy.

They come in many different forms, depending on what they invest in, offering you the flexibility to choose a particular exposure that will fit your overall investment strategy:

Growth Funds

These equity funds focus on companies that may provide above-average potential growth. These are usually smaller but up-and-coming companies that are expected to post high growth over the next few years. An example of this kind of fund is the ATRAM Alpha Opportunity Fund.

Dividend Funds

This is a type of equity fund that invests in stocks that pay regular dividends, usually focusing on established companies that generate consistent earnings. Note that this type of fund does not necessarily give out dividends to investors. Instead, it will reinvest the dividends earned from its stock holdings to grow the value of the mutual fund. An example of this kind of fund is the Philequity Dividend Yield Fund.

Thematic Funds

Some equity funds offer a particular exposure based on themes. For example, they can focus on stocks that belong to the consumer sector, like the First Metro Consumer Fund.

Another example is a fund that intends to capture the foreign participation in our market, such as the Philequity MSCI Philippines Index Fund, which follows the MSCI Philippines Index—a benchmark often used by foreign investors who want to invest in the Philippines.

Index Funds

These are equity funds that track a particular market index. In the case of the Philippines, the market index being tracked is the PSEi, which is composed of the top 30 largest and most traded companies.

Examples of this kind of fund are the First Metro Save and Learn Philippine Index Fund, PAMI Equity Index Fund, Philequity PSE Index Fund, Philippine Stock Index Fund, and Sun Life Prosperity Philippine Stock Index Fund.

Enhanced Index Funds

This is the most common type of equity fund. Majority of an Enhanced Index Fund’s exposure is tied to an index such as the Philippine Stock Exchange Index (PSEi), but the fund can still allocate money in non-index stocks or even have a different weighting compared to the PSEi—depending on the expert view of the fund manager.

The ALFM Growth Fund, ATRAM Philippine Equity Opportunity Fund, First Metro Save and Learn Equity Fund, Philam Strategic Growth Fund, Philequity Fund, and Sun Life Prosperity Equity Fund are examples of a fund with an enhanced index orientation.

Choosing your preferred exposure

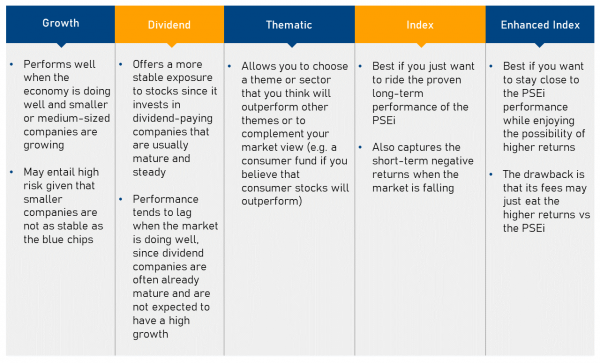

So which particular equity fund should you invest in? The key is to understand how each type performs, and then depending on your preferred strategy and overall market view, you can select the right equity funds for you:

With the many types of equity funds—all available in your COL account—you can find a fund (or funds) that will support your different stock investing strategies while eliminating the need for meticulous stock picking and monitoring.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.