How to make the most of your emergency fund

Ed Martinez

Head of COL Premium

Key Points

An effective emergency fund is PEA or Productive, Enough, and Accessible. - A good money market fund with limited holding periods can give you the best return from cash and cash-link assets. - The standard emergency fund is equivalent to 3 months of your salary which can be adjusted based on experience. - Make sure you put some in cash for more immediate emergencies.

The foundation is the most important part of a building -- it establishes how strong the structure is and determines its ability to withstand the forces of nature. The emergency fund is also where your financial well-being sits upon. Your ability to respond to emergencies, deal with loss of income, and access to more opportunities can help you achieve a stronger financial life that can withstand life’s volatilities.

Safety net during periods of unemployment.

Emergency funds allow us to continue on with life while focusing efforts to becoming productive once again. Having an emergency fund reduces the financial stress associated with unemployment and other financial uncertainties. Recent studies conducted in the United States link financial stress to lower productivity, poorer health, and higher incidence of diseases.

Respond effectively to crises

In many ways, decisions made typically in emergency situations are expensive. Take the case of my mother’s scheduled surgery. In spite of months of intensive preparations, a severe medical emergency occurred to her while on the operating table. Our combined emergency funds were able to quickly decide on the best course of action for my mother which saved her life. This led to a more expensive cost but only in terms of finances. Being able to remove money out of the equation during sudden emergencies will allow you to better decide quickly and more decisively.

Access more opportunities

For those who are employed, having sound finances that stands on a sufficient and accessible emergency fund, gives a certain level of comfort that allows the person to be more social, be perceived as more competent and decisive. It can also serve as a backstop that allows people to increase their ability to take risks and advance their career. In some cases, people used their emergency funds to access opportunities like a new business and other engagements that ultimately increase their earning ability.

A strong emergency fund must be PEA or Productive, Enough, and Accessible.

Productive

Emergency funds can be made productive by putting it in low-volatility asset like money market funds. Money market funds is a kind of mutual fund that invests in short-term, high-quality fixed-income securities. They are in fact better than direct deposits or even high-yielding time deposits where people are more often accustomed to.

1. Low volatility. Your emergency fund is something that you want to be there when you need it. Money market funds have very little movements in price or volatility and is more likely to maintain its value. Money market funds can even resist inflation a little bit better then bank products. On the contrary, products with high volatility like equity funds open the possibility of redeeming your emergency fund at a loss which can affect your ability to use it.

2. Access to opportunities that are exclusive to big depositors. Banks normally give preferential rates for larger depositors while some opportunities are even limited to financial entities or institutions. A money market fund, being an institution that pools many investors, has access to these investment avenues given its size.

3. Surprisingly more liquid. Time deposits usually levy fees when you terminate them before the scheduled maturity. In case of Treasury Bills (like most fixed income), you need to sell to a buyer which is normally the bank itself or the secondary market which may affect the final amount. In the case of money market funds, fund managers are obligated to buy the shares from you thus ensuring conversion to cash given a certain settlement period. Money market funds typically has 3 days clearing time. Holding period for money markets in COL Fund Source could be as long as 7 days. Redeeming within this period will result to a fee.

4. Diversified. Given its structure as a fund, it’s invested in many different liquid assets which makes them diversified and hence making it a tad safer than other products especially the amount if already beyond the PDIC insured portions in case of bank deposits.

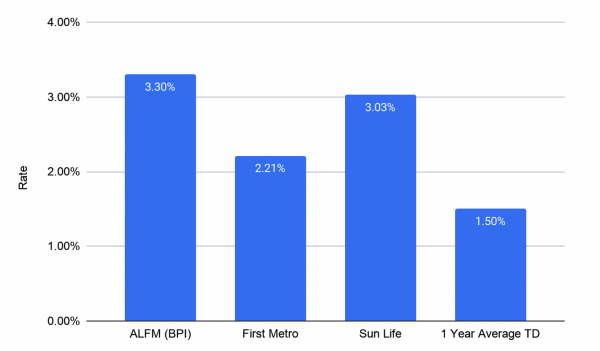

Here is a chart of the average performance of the money market funds available in COL Financial and their comparison to time deposit rates from deposit.org

Enough

The size of emergency funds has a rule of thumb of around three months of your monthly income which is normally based on typical unemployment duration. You may adjust the amount based on your experience and the unemployment duration in your industry. In my case, I keep an emergency fund equivalent to six months of income.

Accessible

Emergency funds should be accessible and within reach hence a good part of it should be in cash. Due to opportunity cost brought about by inflation, a portion of it can still be made productive using products that are suitable. In my case, I still have 10% of my emergency fund in cash, which allows me to respond to very immediate emergencies, and the rest in an asset that is accessible within a 3-day holding period.

How to build

Like in all things, you want to build your emergency fund in a way that’s not too financially intrusive. The initial steps for me was a challenge. It’s either I delayed my “amortizations” to my emergency fund, or spend the money in the account. That was until my mentor taught me that building important things like an emergency fund requires discipline. Just like growing one’s muscles, discipline requires training that builds strength overtime. To build discipline in my early years, I used a company auto-deduct option from my salary to put it in a savings account where I literally cut-off all instant access. That means, I literally destroyed the ATM. I only could access the money when I went to the bank to make a withdrawal. You may find yourself using these measures when you are starting out.

In cases where you are in debt, it is advisable to prioritize addressing your ‘bad’ or high interest debt (i.e. credit card debt, personal loans, 5-6) before you start building your emergency fund. Strategies in dealing with your debt will be discussed in upcoming articles.

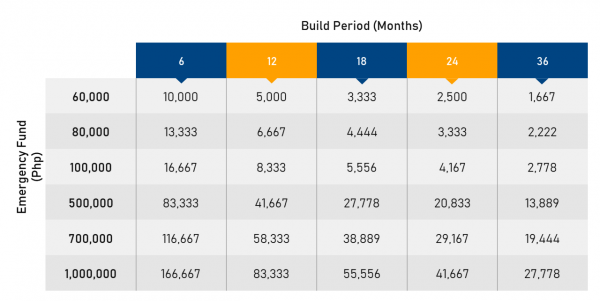

The table above will show you possible amount and build periods. This is essentially dividing the amount with the number of months in the build period. If you were to build Php 100k emergency fund in the next 18 months you have to stash aside P 5,556/ mo. Using automatic deposits in your COL Account, you can use the COL Easy Investment Program to place it in a money market mutual fund on a regular and automated fashion.

In summary: Keeping an emergency fund Productive, Enough, and Accessible will allow you to respond to crises, tide over periods of unemployment and access more opportunities. All in the efforts to provide more than enough for our families and loved ones.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.