The Investment Philosophy of COL's Founder

Edward K. Lee

Expert

Key Points

Three rules from COL’s Founder Chairman that can serve you well in your investing journey: 1. Save. Invest. Reinvest. Watching the markets crash because of the pandemic can be disheartening. This will leave you feeling unsure of what to do next, but let me tell you: trust the process and be consistent. 2. Manage your cash flow well. The general rule when doing your EIP is only investing a manageable portion of your income. This way, you have cash flow allotted for your expenses and emergency fund. The same goes for aspiring day traders. It’s all about cash flow while you learn the game. 3. Know your context. Know who you are as an investor, where you are in the market, and what companies you are buying.

It can be quite refreshing to be asked about my investing philosophy, as it is far from the usual questions I get. For the past five decades, I have enjoyed meeting people from different walks of life. From the top-tier businessmen, curious students, hopeful OFWs, even from someone random down the coffee shop, it is always a pleasure learning from every one of them. They usually ask me, “Which stock do I buy today?”

Depending on the season, trend, or market conditions, I’ll have different answers. Through the years, I’ve seen some of those curious students grow from impulsive teenagers into market veterans and some clueless investors into millionaires, but human nature will always lead them into asking that same old question.

“Give a man a fish and you feed him for a day. Teach a man how to fish and you feed him for a lifetime.”

Most probably a cliché, but COL’s value for education is deeply rooted here. This is why I am happy that this column did not just simply ask me what to buy in today’s market, but about my investment philosophy. Here are my top three answers:

1. Save. Invest. Reinvest.

Surprise, it’s not a new magic formula. You might be disappointed reading this same old quote, but I’ll repeat it anyway. Always remember, investing is not entertainment. Investing can be boring but still brings you closer to your financial goals. If you want an exciting game, bring it to the casino for the jackpot instead. Investing in the long term requires patience and consistency. Wealth is not built overnight.

As with the markets today, I know it is easy to question the long game in the stock market. Your fear is both normal and valid. This is your hard-earned money we are talking about. They are not just numbers in your portfolio. They are long hours of overtime and sacrifice. Watching the markets crash because of the pandemic can be disheartening. Take a deep breath, and zoom out. Look at all the past market cycles. From the Martial Law, the Asian Financial Crisis, and the Subprime Mortgage Crisis, there was blood in the streets. We never knew when those times were going to last, just like how we are feeling today.

This will leave you feeling unsure of what to do next, but let me tell you: trust the process and be consistent. If you’ve been doing the Easy Investment Program (EIP) for the past few years, this is the worst time to stop. If you have not started yet, buying stocks while they are cheap is a good idea.

2. It’s a cash flow game.

The general rule when doing your EIP is only investing a manageable portion of your income. This way, you have cash flow allotted for your expenses and emergency fund. Treating your stock market account as a wallet where you withdraw whenever you need to spend is not ideal.

The same goes for aspiring day traders. The stock market was never an easy game. Being a full-time trader can take years of cash burn before the learning curve allows you to be consistently profitable. 95% of active traders lose money, and many give up within a few months. What’s the secret? It’s all about cash flow while you learn the game. Getting pressured to put food on the table while learning the craft can be detrimental to your trading.

Once you become consistent, it remains a cash flow game. This is the reason why even day traders usually have long term positions. Tagged by the popular Adam Khoo as the Value Momentum Investment Strategy, this has been our formula for years— “Day trade to build cash flow. Position trade to build wealth.”

3. Context is everything.

Blanket advice can be dangerous. Doctors and lawyers need a deep context before they give out advice, and the same goes for stocks.

Context #1: Know who you are.

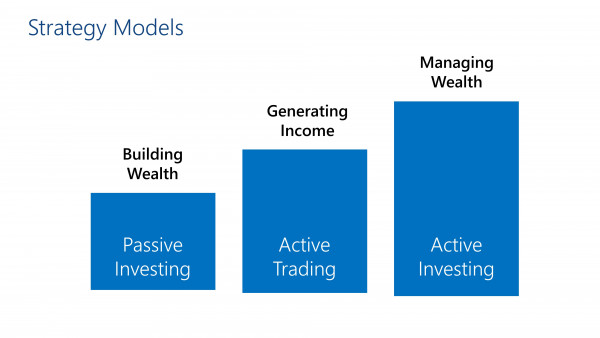

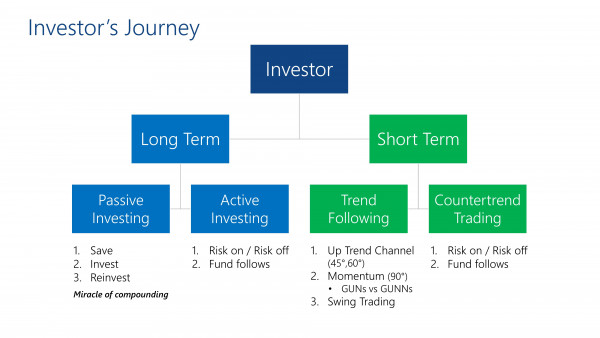

Before jumping into stock picks, determine the context as to what kind of game you are playing. Consider the Investors’ Journey. What are your objectives? What is your general strategy?

Context #2: Know where you are in the market.

Check out the Bull-Bear Cycle chart. A high tide lifts all boats. The same is true with bear markets -- it can be futile to day trade every single day on barren land. This will help you level your expectations even when you are investing for the long term.

Context #3: Know what company you are buying.

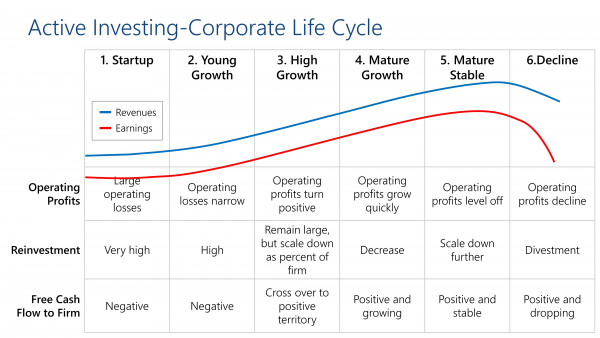

In the long-run, earnings and stock price will be directly correlated. This is where fundamental analysis comes in. Is the stock you are buying expensive or cheap? Is it a high growth or mature type? Is it established enough to weather the bad times for the next ten years? Or is it banking on a future growth story that is not yet there? Context of the company you are buying will help you have realistic expectations about the stock.

Remember these three rules. The journey to financial freedom can be a long one and it is easy to get derailed during hard times. Just trust the process and be consistent. Though it is important, let us not forget that there is more to life than money. At the end of the day, this pandemic has changed so many norms and, has rendered branded shoes and expensive sports cars worthless. Indeed, this quarantine has taught me that it is all about the family we cherish and the meaningful relationships we build over time, which are essentially the things that truly matter.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.