How to Have a Financially Comfortable Life After You Retire

Marvin V. Fausto

President, COL Investment Management

Key Points

Designing an investment strategy for your future highly depends on each individual’s situation and goals. Regardless of how the markets perform, one needs to go through the investment process, and design a suitable portfolio. Set your target, determine the investment allocation, and then select the specific investments. Follow the process and make the necessary adjustments along the way and you will be on your way to live a comfortable retirement.

A crisis event usually heightens people’s awareness of what lies ahead for their future. With the kind of return people get these days — from time deposits and bonds, and to the volatile movement of the stock market — one can really be concerned with what investment strategy to implement in order to prepare for a comfortable life in the future.

Set Your Target

My approach to addressing this concern is to first establish the goal in mind then the investment strategy can come after. Like in any investment goal, you just have to do the math first. Come up with an estimate of how much it costs to live a comfortable life for yourself and the people you care for. That estimated figure then will determine the goal upon which to base your investment strategy. While no one can really predict what you will exactly need in the future, having a workable estimate would better guide your preparation.

Two Things to consider in coming up with a number:

1. How much does it cost for you to live comfortably?

2. How many years before you reach retirement?

Let’s take an example. If you are in your 30s comfortably living with ₱60,000 a month figure with the plan to retire at 65 and hope to live to 85, a good working retirement goal is around ₱14.4 million – (monthly expense x 12 x 20 years). It may be a big amount but this is your initial target to accumulate in assets throughout your productive years from age 30 all the way to 65, or a total of 35 years. The idea is to live within your means throughout your life allowing you to set aside the needed monthly savings that you can invest regularly for long-term growth. Definitely, a lot of things can change and a lot of variables can come into play such as increasing costs, medical expenses, and future personal circumstances such as lifestyle change, getting married and raising a family. Your target goal will definitely be subject to change. But this amount is a starting point for the purpose of coming up with a working target. Then adjust for material changes as you go along with your life.

Allocate

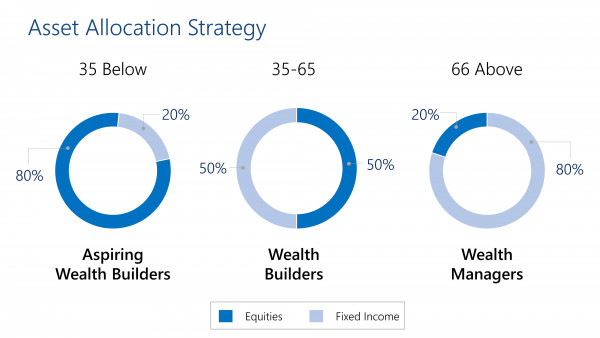

Once you have established a working target for your monthly and future goals, the next step is to set an asset allocation strategy suitable for your current situation. For those belonging to the Gen Z and younger Millennials or those belonging to what I consider the “Aspiring Wealth-Builders” category, it is ideal to have a more aggressive strategy due to the longer period of time before reaching the age of retirement. At this stage, you can afford to take more risks, ride the volatilities of the market, and maximize its growth potential. I tell my children, nephews, and nieces belonging to this generation to have a larger exposure in the equities market. Due to the nature of the investment, equities can provide good returns over the long-term.

For those a bit older Millennials and Generation X, or those belonging to what I consider to be in the “Wealth-Builders” category, a more balanced portfolio is recommended. They have more or less established a career and maybe raising their own families so adding stability to their portfolio is paramount. A good mix of equities and bonds would provide a comfortable combination of risk and return.

For those older in the Baby Boomers generation or those belonging to what I consider to be in the “Wealth-Managers” category, a more conservative portfolio is recommended. They have matured in their careers and accumulated assets but would want to preserve and continue to manage the wealth built over the years to prepare for a comfortable retirement. A good mix tilted more towards fixed income for income and stability, but still with equities to have some growth in the portfolio is ideal.

Needless to say, these are general guidelines and would have to be adjusted to suit the specific circumstances of each individual. Just like in arriving at a working target, the mix of both fixed income and equities should be adjusted according to the situation they are in.

To illustrate the different asset allocation mix, refer to the following chart for a simple guide:

Select Investments

In choosing the specific securities to fill in the allocation, the level of interest rates will serve as the benchmark to what specific assets to invest in. The current economic environment both locally and globally forced central banks to reduce interest rates to record low levels. And with how the pandemic has affected most countries, it seems like low-interest rates are here to stay for quite some time in order to encourage more economic activity. It will also enable countries to recover from the recession and enter the path of a more sustainable growth.

For the fixed income portion of the portfolio, check the level of inflation in relation to the interest rates of the fixed income instruments being offered. Invest portions of your portfolio in long term should the bonds have rates at comfortably higher of about 2% to 3% above inflation. If the bond rates are somewhere at or lower than inflation, keep them tilted in the short to medium term until rates become more attractive and comfortably higher than inflation before considering long-term. In so doing, you will allow your funds to generate yields enough to keep up with the increasing costs of living.

For the equities portion of the portfolio, best to start with equity index funds to represent the strategic allocation of the portfolio. Equity index funds are like investing in the 30 largest and most valuable companies listed in the stock exchange — an investment I consider to be the most efficient way to diversify. This investment is particularly ideal as a core holding position for aspiring wealth-builders and wealth-builders alike as they accumulate assets throughout their productive lives. Should total equities reach a meaningful level and you have time to study the markets closer, stock specific investments can then be considered for tactical allocation to add variety to your portfolio. In this period where economies prepare to get back to normal, cyclical stocks whose businesses ride with the recovery of the economy will serve as a good tactical allocation.

Review and Rebalance

While going through your investment journey, things happen along the way — markets move, choices are made, priorities are realigned. It is then ideal to review your targets and rebalance your allocation at least once a year or as often as necessary. I do this with my family and most specifically during our year-end family goal-setting vacation trip. Right after Christmas, we go to a place we have not been to before and allocate half a day to review our accomplishments during the year and share our goals and dreams for the coming year. I found it a good way to end the year with the family mixed with fun and relaxation and to prepare ourselves for a challenging year ahead. While this year-end trip destination is still tentative given the required protocols, the goal-setting review will push through no matter where we end up going.

It’s the Process

We cannot accurately predict how the economy will move, where interest rates will go, and how markets will perform. While we do not have control of what lies ahead, we can take control of what is upon us. We can monitor our expenses, put aside the needed savings, and choose where to invest. We can take control of the process — of estimating our targets, setting our allocation, identifying specific investment outlets, and rebalancing our portfolios along the way. Giving attention to the process will make the uncertainty a little bit more manageable as you go through your investment journey. This way you can be more at peace as you go through your path towards living a comfortable retirement.

Good luck and here’s wishing you a comfortable retirement ahead.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.