Portfolio Strategy to Start Your Year Right

Marvin V. Fausto

President, COL Investment Management

Key Points

After an unforgettable 2020, preparing for 2021 gives us new hope. Being more attuned to market developments will allow us to design our portfolios and prepare better for the upcoming challenges this coming year. Given the current landscape, here are the tips on what investors should do with their portfolio to start the year: • Replenish your emergency funds • Review your short-term and long-term investment strategy • Ready yourself for the opportunities the market will bring this 2021

Preparing for 2021

2020 could well be marked as one of the most unforgettable years and people are just relieved and looking forward with renewed optimism to a better 2021. However, the virus is still with us, the vaccine is slow in coming, and major parts of the economy are still in quarantine. There is even the nagging risk of a possible second wave of infection and even another virus strain, incidents experienced by other countries.

Last year, some may have used up their emergency funds to tide them over. Interest rates reached record lows with bonds generating only around 3-4% returns while the stock market went on wild swings and ended the year down 8.6%.

For 2021, portfolios then need to be assessed and recalibrated to prepare for a slow and could well be a year with a different set of challenges.

Replenish Emergency Funds

To start off, short-term funds to cover immediate requirements need to be replenished and ready to support at least 3 to 6 months of regular expenses to prepare for any contingencies. Some may have used this up at the height of the economy’s lockdown to support their businesses. Ideal instruments to build this up again are in money market funds that provide a liquid but with still a yield of 1-2% on your funds. This can be done online and can easily be liquidated and credited to your bank account for your immediate use.

For Medium-Term Funding Requirements

For financial needs that you have to prepare for in the next two to three years, the ideal instruments to invest in are bonds. These are fixed-income instruments with regular interest and generate yields higher than money market funds. Investing directly in government securities or corporate bonds normally is the ideal way, however, yields at present are not that attractive. There is even a risk that interest rates could go up if inflation accelerates much faster than expected. Direct bonds currently have low-interest rates anywhere from 2% to 3% gross of the 20% tax, or a net rate of only 1.6% to 2.4%, even lower than the most recent December 2020 inflation rate of 3.5%. This is an offshoot of the current situation of abundant liquidity in the financial system. To help encourage economic activity, our central bank took on a more accommodative monetary policy by reducing interest rates to historically low levels. The central bank governor was even quoted to say they will keep rates low for many quarters to come. Only when interest rates move comfortably above inflation expectations should one consider investing in these direct bond instruments to leave some margin above increasing prices.

Alternatively, a bond mutual fund may be a better investment for this purpose since it is more diversified with securities spread over different instruments. Of late, bond fund managers already rebalanced their fund maturities to improve performance, mixing short-term outlets with longer but higher-yielding investments but still keeping within the general strategy of a medium-term portfolio. This way, in the event that interest rates rise, the bond fund can still ride the uptrend and not be completely stuck with low interest-bearing bonds.

For Long-Term Requirements

For the portion of your funds dedicated to equities, it becomes challenging as well. With the stock market starting the year at 7,140 on the PSEi, analysts are pricing it at around 19.7X price to earnings ratio (PE) on 2021 earnings estimates, a level considered already above historical averages. At this level, the market has gone a bit ahead of fundamentals anticipating the economic recovery and already pricing in analysts’ expectations for the year. While it may still have room to rise, the stock market will have to be driven more by liquidity inflows both from the increasing retail investor participation and the subsequent inflows from institutional investors. Corporate earnings will have to take a back seat in supporting the market for the meantime while waiting for recovery. Given where interest rates are with the 10-year government bond at 3% (or a net of 2.4%) keeping investments in the stock market may well be justified. With a PE of 19.7X, the stock market’s expected earnings yield (or the inverse of its PE) is at 5%, much better compared with the 10-year bond. In addition, institutional investors like pension funds will increasingly have to allocate more to riskier assets like equities for the potential of generating higher yields. These funds may not be able to meet their long-term objectives of providing enough pension payments with just having an ultra-conservative portfolio predominantly in fixed income. Also, inflows from foreign fund managers are likewise anticipated with the recovery of the economy this year.

A long-term core strategy should then remain at play. Index mutual funds or stocks representing the index should continue to be a core position as institutional inflows in these investments are expected to sustain. Market timers and stock pickers, on the other hand, may find opportunities in cyclical stocks or stocks that perform with the economy and high dividend-paying stocks like telecoms and REITs. There are also stocks that have lagged their specific sectors in terms of price movement and benefit as the economy recovers.

All in all, portfolios must be geared toward a more flexible mix, well prepared for another challenging year. Higher earnings expectations and risks of a possible second wave of infection as well as an ineffective vaccine program may disappoint investors creating volatility in the market and may offer opportunities to invest should markets decline.

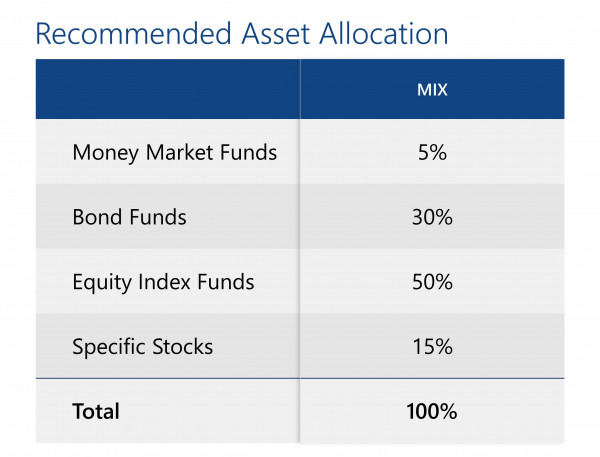

So, to better start your 2021, make sure to have the needed emergency buffer, be selective in your choice of bond investments, and have a core position in equities and be more attuned to the opportunities the markets will bring. Depending on each individual’s circumstances, shown below is a portfolio mix given my discussions above.

Good luck and here’s wishing you a renewed and prosperous 2021.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.