2020’s Top 3 Mutual Fund Investing Lessons

Mark Ilao

Head of COL Fund Source

Key Points

2020 highlighted three lessons that are often overlooked or disregarded by mutual fund investors: 1. Understanding investment risk beforehand and not after Even before you decide to invest, determine your risk tolerance or the amount of risk you are prepared to handle while making an investment decision. 2. Diversifying across different funds really matters By having the right portfolio mix, you reduce the amount of risk and maximize returns by investing in different areas that would each react differently to the same event. 3. Sticking to your investment goals is your north star For a better perspective, remind yourself of your overall investment objectives and adhere to them.

To say that 2020 has been life-changing seems to be an understatement given all that happened throughout the year, including the roller coaster movements in the financial markets. Without a doubt, last year proved to be a tough test for market participants, be it for long-term investors or seasoned traders alike.

In my view, there are three particular lessons that mutual fund investors should take away from 2020 to continue improving their investment journey moving forward. These lessons are by no means revolutionary ideas, but ones that I believe are often overlooked or even disregarded by investors.

Lesson # 1: Understanding investment risk beforehand and not after

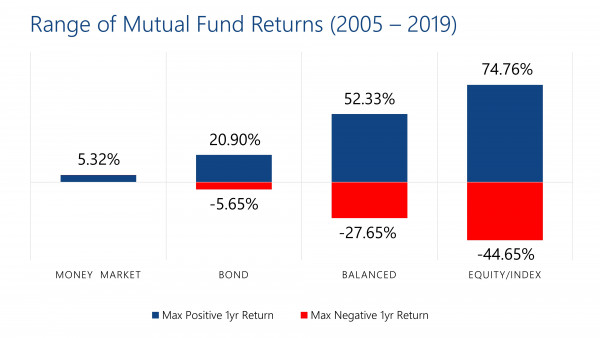

All of us want the best possible returns in the shortest amount of time, but it should not come at the expense of emotional anxiety especially when the prices of our investments fluctuate. Last year, seeing the stock market fall by as much as 40% highlighted the risk when investing in stocks especially in the short term. However, if you truly understand the risk profile of each investment, you should’ve known that such movement is indeed possible to happen. In fact, the historical performance of different mutual funds the past 15 years reveals this truth:

This suggests that even before (and not after) we decide to put money or add more money into an investment, we should know if we have the ability and willingness to take on the risks that come with them.

For 2021, a question that you should ask yourself then is: “Am I comfortable with my current mix of investments?”

Take this time to review what percentage of your money is in the stock market versus cash or other instruments. This would allow you to adjust your portfolio, especially if you have most of your money in just one type of investment.

Lesson # 2: Diversifying across different funds really matters

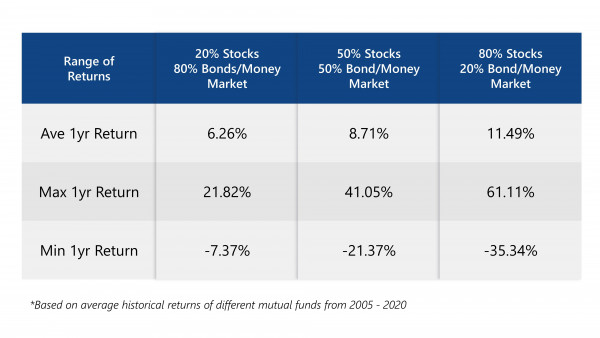

Speaking of having just one type of investment, it is a known fact that most COL clients put their money only in stocks. While that may be acceptable for some given their risk tolerance, for the greater majority, it is best that we have a good mix of several investments to help us manage risks and give us flexibility with our investment actions. Last year, while stock-related mutual funds were down, bond funds and money market funds remained resilient.

As such, having a combination of lower-risk investments like a money market fund or bond fund along with your equity investments would allow you to not only protect your capital in times of crisis but also give you ammunition to rebalance your portfolio. If most of your money were just invested in stocks, you would have had no choice but just to wait out the recovery and miss some opportunities. But if you had, say, 40-50% in the money market or bond fund, you could have used some of that portion to buy stocks when prices were cheap.

As a quick guide, you may use the table below to help you assess if you have the right portfolio mix:

Lesson # 3: Sticking to your investment goals is your north star

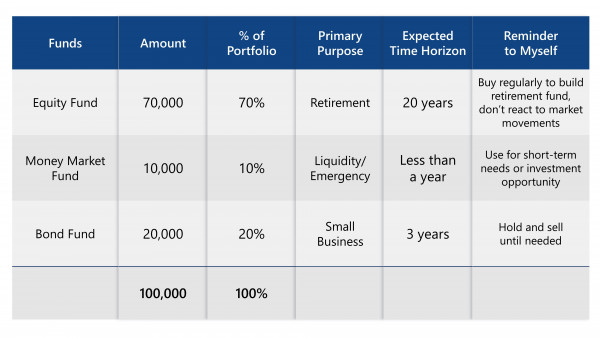

It has been said that investing is all about discipline, but that is hard to do when your emotions are affected by the up and down movements of prices. Some investors react to price actions because they can monitor the markets and use tools to aid their decisions. For most mutual fund investors, however, the key is to remind yourself of your investment goals – when you invested your money in a specific fund, ask yourself, what was my objective? This would allow you to always have a better perspective and not simply be reactive to current market conditions.

For example, while it could have been tempting to sell everything in the stock market and walk away till prices settled, holding steady would’ve actually favored long-term investors more given the market recovery that happened since March 2020.

To start the year, perhaps you may create a table of your current investments like the one below and keep it close to you so are always reminded of your investment objectives:

There are lessons to be learned every year when you’re investing and ultimately it is upon us to heed the lessons given to us by the markets. Here’s to hoping that 2021 will take you closer to a richer life!

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.