How to Create an Effective Goal-Based Portfolio

Mark Ilao

Head of COL Fund Source

Key Points

• Before even thinking about which particular investments to buy, new investors should first understand their goals and assess their financial needs • All our personal goals can be lumped into five buckets: 1. Emergency needs 2. Liquid cash for opportunities 3. Imminent goals 4. Future lifestyle support 5. Aspirational goals • Mutual funds will allow you to expand your investment universe and access instruments that are best suited to address your specific needs

For most first-time investors, their biggest concern is usually about how to find which stock or investment will provide the best possible returns.

The easiest thing to do is to simply go for the trending stocks that you see on social media. While this may be convenient, it’s a risky move. It may be a good investment for someone else, but not necessarily for you.

We all want investments with the highest returns, but we need to consider important factors like our budget and needs, time horizon and age, and risk preference when investing our hard-earned money.

That is why even before thinking of a particular investment option, it is best that you take a step back and consider your goals first, so that you can build an investment portfolio that’s most appropriate for what you actually need.

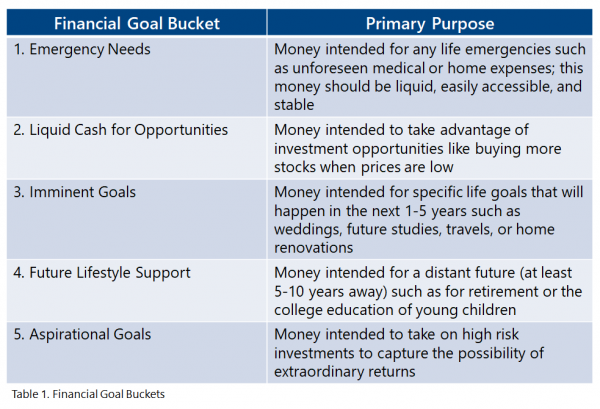

Although we may have different investment goals that are unique to our personal circumstances, we can lump together all our investment objectives into these five common financial goal buckets:

Looking at our investment goals this way allows us to reframe the usual concern of first-time investors, from thinking “Which particular investment will give me the highest results?” to “Which particular investment is the most appropriate for my different needs?”

To address this question, you have to be familiar with all other available investments aside from the stock market.

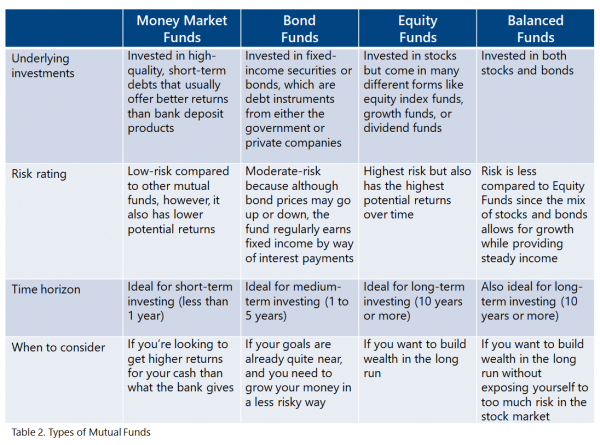

This is where mutual funds come in. Mutual funds are professionally-managed products that are invested in money market instruments, bonds, stocks, or a combination of all these. Using mutual funds will expand your investment universe and give you exposure to different financial assets that can help you meet your various goals.

As an overview, here are the different types of mutual funds and what they are best for:

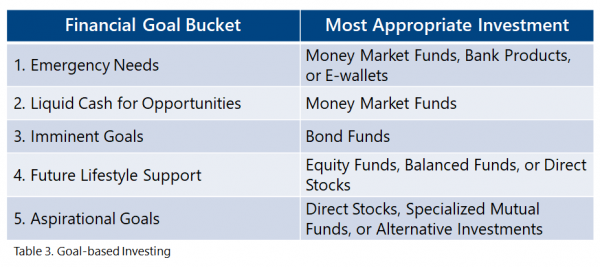

Going back to the five financial goal buckets mentioned earlier, you can then make use of the different mutual funds to create a goal-based portfolio.

For example:

Depending on your circumstances, you will need to adjust how much of your money will be allocated into each bucket. Only then can you strategically choose the specific investments that you prefer.

Creating a goal-based portfolio will allow you to regularly measure the results of your investments versus the actual goals you want to achieve. Using this approach will also ensure that you’re not taking too much or too little risk since you can intentionally set aside your money for a particular need.

Ultimately, whether you’re investing for a distant goal or for something much sooner, and depending on how much risk you’re willing to take, you can use the various kinds of mutual funds to create an investment portfolio that’s tailor fit to your circumstances and needs.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.