Speculating on Stories: Finding Sustainable Value

Juanis G. Barredo

Expert

Key Points

Some stocks rise fast because of the stories that surround their companies, but not all stories are equal. It’s important to distinguish momentum driven by real stories from those driven by copycats: • Real stories are about factual strengths of the underlying business that can lead to a sustainable increase in prices after an initial exploratory, speculation-driven phase • Pseudo or copycat stories consist mainly of hype and rumor or associated storylines, and the price fluctuations they cause are rapid and treacherous, never reaching sustainability • Stocks with prices that rise abnormally fast should be approached with caution, especially for a new investor

Can you remember when you first became interested in the stock market? Chances are, you can trace that interest back to a story. Maybe it was a story you heard on the news, read in an article, or mentioned by a friend who invests.

Stories play a key role in how we learn since our brains are wired to respond to narratives. Humans are constantly on the lookout for patterns, and a story is one way to tie a group of events together, or to find meaning and motivation.

It should come as no surprise then that stories can influence the way stocks move and the way the market behaves. The stories around a stock can motivate people to invest or turn people away. This is especially true for what we call momentum stocks—stocks with rapidly rising prices driven by a lot of activity from investors who are banking on that momentum to continue.

However, it’s important for a new investor to take a closer look at the stories that are driving these movements. These stories can reveal whether a stock is backed by a sustainable business or if the movement is merely a product of unsubstantiated hype.

You can tell a company is backed by a sustainable business if the movement of its stock is produced by realistic stories.

These stories cause a positive change in prices because they are based on something that will produce a tangible benefit in the business or earnings of a company. These tend to be the results of sustainable action by the corporation and are supported by facts rather than by rumors.

On the other hand, there are what may be called “Copycat” or “Pseudo Stock” stories.

These are rumors, unconfirmed reports, or viral hype that move prices through the creation of a craze or mania, or through an appeal via association, or through sentiment.

The movement of prices created here are not actually based on the underlying business of the corporation, but on the stories alone—stories that can disappear as quickly as they appear. When that happens, the stock fades back into anonymity, with many rash investors being getting stuck with a bad stock for a long period of time.

Stocks backed by different stories will also display different timelines of movement.

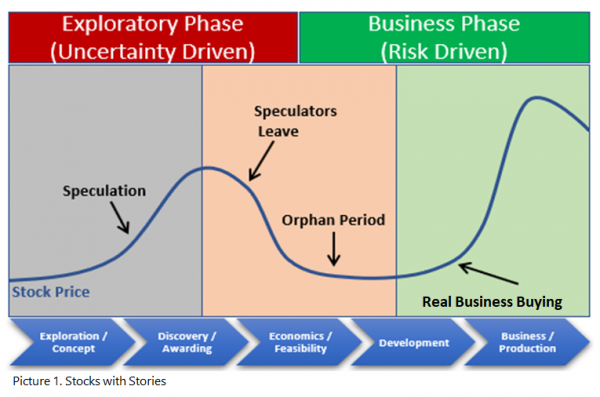

Stocks backed by a real story will first go through an exploratory phase, before transitioning to a business phase. The first phase is one of uncertainty, as the real business has not quite come in yet. Even at that point, people hear the story of the corporation and this creates interest in what the company will become in the future. The stock surges and speculators join in, looking for a quick profit, and this drives prices up.

Eventually the speculators leave, and the price of the stock comes back down—this is called the Orphan Period because the stock appears to have been left behind, as the valuations do not merit the high price. But because the story was based on the underlying business, over time the company will finally begin to see a profit. At this point, the stock enters the Business Phase. Here, we see movement caused by real business buying, and the increase in the price becomes sustainable over a long-term.

With Pseudo-stories and Copycats, the stock never enters the Business Phase. Instead, we see a cycle of boom and bust (from the speculation phase to the orphan phase and then back again), never achieving sustainability. After which, they stay quiet for a long period of time until the next concocted story. It’s not so much “high risk and high reward” but rather “uncertain risk and uncertain reward.” Bottom line is buying into stocks with pseudo or copycat stories is always a big gamble.

As a new investor, you’ll be attracted to momentum-driven stocks. But in making your investment decisions, you should be guided by the stories causing momentum swings, and by the way the stocks move.

When prices rise abnormally fast, beyond a metric like the short-term moving average can support, this should make you take a pause. It may be a stock based on a pseudo/copycat story, which could implode just as fast as they rise, and take your money down with them.

If you’re not certain that you can sell a stock while it’s still on its way up, then the volume you put into the stock should be moderated and should only be a minor part of your portfolio.

As a new investor, one of the first lessons you need to learn is how to protect yourself. Otherwise, your own story may just become a cautionary tale on speculating in stories.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.