Investing Based on Your Risk Tolerance

Marvin V. Fausto

President, COL Investment Management

Key Points

Generally, investments with higher returns also come with higher risks. That is why having a better understanding of your willingness to take risks will allow you to make smarter investing decisions. Here are three questions you can ask yourself to help you learn more about your risk tolerance.

Risk is one of the most important things every investor should consider at every stage of their investing journey. Risk is defined as the possibility of losing some or all of your original investments. Risk tolerance, on the other hand, is an investor’s ability or willingness to endure losses for the chance of getting returns.

Generally, investments with higher returns also come with higher risks. That is why having a better understanding of how much risk you can take will allow you to make smarter investing decisions.

To help you learn about your risk tolerance, here are three questions you can ask yourself:

1. What is your time horizon?

First, you need to ask yourself how long you’re planning to hold on to your investment. If you’re investing for the short term—less than a year—you’ll have fewer chances to recover if the stock market dips, so it’s better to have investments that are less volatile and more conservative in nature.

Conversely, when you're investing for the long term—over 5 or even 10 years—you can afford to wait out any short-term volatility and stock market swings, so you can have investments that are riskier in nature.

2. How much investing knowledge & experience do you have?

Did you just start investing or have you been investing for years now? Have you watched video resources on investing, attended webinars by investment experts, or perhaps read books on investing? Understanding how much you know about investing or how much experience you have will help you determine how much risk you can take on.

If you are more knowledgeable and more experienced in investing, it can be easier for you to take on riskier investments since you’ll know how to navigate the ups and downs of the market. However, you should also remember not to overestimate your abilities to avoid taking unnecessary risks.

3. What is your attitude towards risk?

Are you comfortable with the ups and downs of the stock market, or are you more likely to get stressed? If you are more likely to feel anxious when your investments decline in value, then more conservative investments with lesser volatility may be better for you. On the other hand, if you’re comfortable with market volatility, then you can take advantage of investments that have higher risks but also higher potential returns.

So now that I know how much risk I can tolerate, where should I invest?

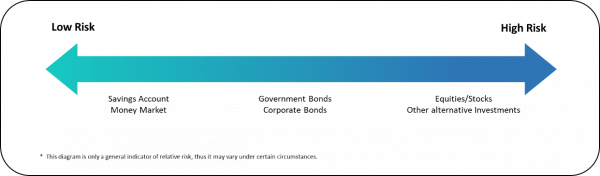

Different financial instruments have different risk ratings: those on the lower end are considered safer while those on the higher end are considered risky. Usually, investments with low risk ratings are liquid (easily converted to cash) and have lower volatility—money market instruments and bonds fall under this category.

Money market instruments are short-term investments that generally mature or end in less than a year. They are composed of highly-liquid assets such as special time deposits, Treasury bills and more. Bonds, on the other hand, are fixed-income investments that represent a loan made by corporations or governments. They pay out interests in the form of coupons. For corporations offering bonds, debt is often fixed and is paid-up first before dividends which is why it is often considered less risky than stocks.

Stocks, on the other hand, have a higher risk rating than the rest, but they also have the highest potential returns. You can earn through stocks in two ways: dividends and capital appreciation. Dividends are earnings that the company decides to give out to investors, while capital appreciation refers to the increase of an investment’s value. Stock prices can go up really high, but it can do the opposite as well which is why it’s considered a risky investment.

Conclusion

Take the time to learn about your time horizon and how you feel about risk because this is essential in creating your overall investment plan and strategy. Understanding how much risk you can tolerate will also greatly help you in filtering out and choosing the right investments that best suit you. And to top it all off, having a clear grasp of your risk tolerance will help ease your worries in times of uncertainty and market volatility.

To learn more about what investments to pick and how to build your investing strategies:

• Watch our educational videos when you subscribe to our YouTube channel at youtube.com/colfinancial

• Read our latest research reports when you log in to your COL account

• Attend our free investing webinars at bit.ly/COLevents2022

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.