3 Reasons Why You Should Start Investing Globally

COL Fund Source

Expert

Key Points

Investing overseas has always seemed out of reach for most Filipinos, but recent developments have made access to these opportunities so much easier now. Here are 3 reasons why you should invest offshore to diversify your portfolio.

Until the last few years, investing overseas has always seemed out of reach for most Filipinos, but recent developments in financial markets and technology have made access to these opportunities so much easier now.

But before we look at how easy it is to invest overseas, let’s first look at the three reasons why considering offshore strategies can be a good way to diversify your portfolio:

1. There is a larger market outside the Philippines

As of 2020, the Philippine stock market is valued at $272,790 million USD, while the overall combined stock market of the world is valued at $93,686,226 million USD. This means that the local stock market is roughly 0.3% of the world and we are only able to partake in a small portion of the growth that is happening globally.

By diversifying outside the Philippines, you can tap into larger markets where global household names like Apple, Microsoft, and Amazon are located, as well as, other markets whose companies are benefiting from global growth.

2. There is a wider range of options for you to choose from

Investing offshore allows you to access various investment options from different countries, industries, and emerging trends that may not be easily accessible locally.

For example, you may prefer to invest in the US for its technology and consumer companies, or Europe for its more advanced healthcare technologies. There are also specific themes like clean energy, dividend-paying, and other global themes that you can participate in. Such industries and themes may not be present locally or may not be at the same level as those overseas.

3. It’s a good way to manage risk and find opportunities

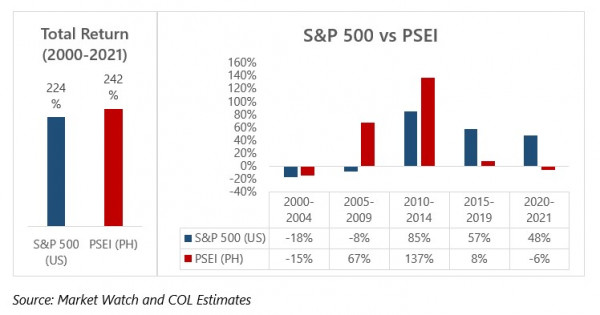

Having a globally diversified portfolio can allow you to better manage risks since it’s not tied to a single country or economy, and you’re able to diversify and access opportunities from around the globe. Just take a look at the image below:

As you can see, over the long term both the Philippine and US stock market has grown significantly by more than 200% in the last 21 years. However, there were certain periods when growth was either negative or slow for one of the markets. Having access to both provides you an option to choose how to allocate your money to manage risks and find potential returns.

Things to look out for when investing overseas

Global investing has a lot of benefits but here are a few things that investors should be aware of when investing globally:

1. Transaction Costs

There are usually higher transaction fees or expenses involved when investing outside the country due to the added cost of conducting business overseas. It’s important to know what the relevant fees are and how they all add up since these will likely affect the performance of your investments.

2. Currency Fluctuations

Depending on exchange rate fluctuations, it may benefit or hurt your global investments. Global investments that are denominated in the Philippine peso generally benefit when the peso depreciates, although they may face lower returns when the peso appreciates.

How can you access global investments?

One of the easiest ways to diversify overseas is through peso-denominated mutual funds and UITFs that invest primarily outside the Philippines.

This is now much simpler since you no longer need accounts with global brokers who require larger amounts of money to start investing. You can easily access these products online through local stock brokerages such as COL Financial and fund houses at a much smaller amount.

Through funds, you are automatically diversified and would no longer have to be an expert in global investing or need to actively select stocks since this is already done by a fund manager. You can also easily invest using your Philippine peso without worrying about converting currenciesD since this is also already handled by fund managers.

If you’re interested in starting your global investing journey, go to COL Fund Source and use the “Global” filter to see the list of offshore strategies available and learn more about these funds.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.