Are You Ready to Go Global?

COL Fund Source

Expert

Key Points

Solely investing in the local market may provide a sense of familiarity and comfort, but it's important to recognize its limitations, especially during tough local economic conditions. In this article, we'll explore the benefits of global investing and the different opportunities it provides for growing your wealth.

Imagine owning a piece of the world - from the largest tech titans driving innovation, to health care pioneers advancing in human well-being, or emerging economies that have untapped growth - global investing allows you to take advantage of these opportunities. But is this strategy for you? Let’s find out.

The Highway to Growth

While investing solely in the local market may provide a sense of familiarity and comfort, like driving on well-known roads, it is important to recognize its limitations, especially during challenging economic and business conditions locally. Having alternative options like global investments can give you a broader set of opportunities for growing your portfolio.

Think of it as building a network of highways instead of relying on a single road. Spreading your investments across multiple routes will reduce your dependence on the performance of just one economy so if you encounter a "traffic jam" in a particular region, your other investments can keep you moving towards your financial goal. Over the last 15 years, including global investments in a portfolio would have yielded higher returns for a much lower risk.

(Sample illustration)

The Express Lane to Global Markets

The desire to personally hand pick your own investments–stocks, bonds, and even real estate–is certainly appealing, but the reality is that it can be complex and time consuming. This is where global funds, like mutual funds and UITFs, become your express lane to global investing since they offer a simpler and more accessible way to participate.

Think of it like a carpool where many investors contribute their money to invest in a basket of companies based on a particular country, industry, or theme. For example, if you wish to invest in health-related stocks but don’t know where to start, you can look for a global fund that specializes in investing in different health and healthcare-related companies. The fund managers do all the research and tasks to be able to invest, saving you time and effort.

But before starting your engines, you might be asking yourself:

Are You Ready to Go Global?

To know whether you are, here’s a list of questions that you may want to look at:

Are you already investing locally?

When you invest in funds that spread their holdings across the globe, you reap the benefits of diversification. In that sense, the ideal strategy is to find the balance in local and global funds, while aligning your risk tolerance with your financial goals.

If yes, this is a good starting point for diversification. Global funds can complement this by introducing more options that may not move in sync with the local market.

If no, global funds can still be an option, but it might be prudent to start with local funds first. Seeing the familiar companies react to the economic changes provides firsthand experience in how different factors impact your investments.

Do you know which global funds are right for you?

Knowing about the different types of global investments is important for curating an investment plan that suits your financial goals. You can either focus on a specific country, industry or, asset class.

Here are a few examples:

- Country equity funds invest in specific countries or regions

- Thematic equity funds invest in specific sectors or themes

- Income-paying balanced funds invest in a mix of stocks and bonds while paying out income to its fund holders

Look at how these investments align with your investing goals.

Do you understand the risks associated with global investing?

All investments carry risk, including global investments. Aside from the typical risks associated with investing, global investing is also affected by potential currency fluctuations.

Depending on how the Philippine peso moves against other currencies, this may have a corresponding effect to the peso value of your foreign investments. For example, if the PH peso appreciates or strengthens against the currency your foreign investment is in, your investment may be converted back to fewer pesos when you redeem it. On the other hand, if the PH peso weakens, you may get a higher peso value when you redeem your foreign investment.

Are you aware of the costs of global investing?

Global funds typically have higher management fees due to the added complexities of global investing, such as transacting in foreign currencies, researching foreign markets, and with some funds feeding into other global funds overseas. To compare fees, focus on two key metrics:

• Management Fee: This is the payment made to the fund’s managers for handling your investments.

• Expense Ratio: This is the overall cost incurred by a fund including management fee, admin fees, and other costs.

Remember, fees can erode potential returns so lower fees are generally preferred. It is important to look at the relevant costs like the management fee and expense ratio and balance them with their performance to make sure you’re getting the best option.

Ready, set, go!

If you’re ready to look into global funds, log in to your COL account and check them out:

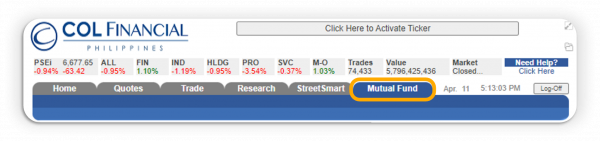

1) Click the “Mutual Funds” tab on the home page.

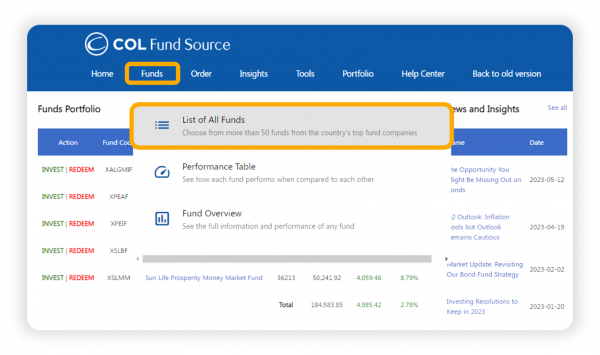

2) Click on the 'Funds' tab and 'List of All Funds'

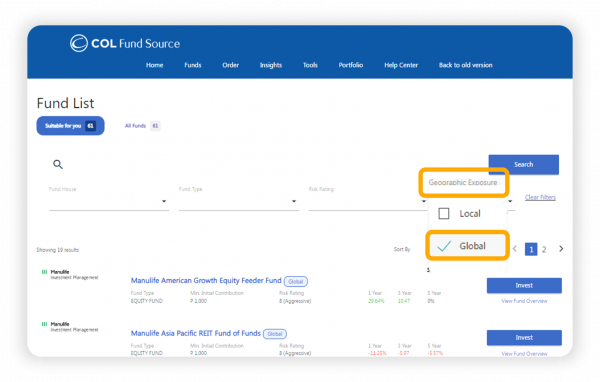

3) Filter the funds by choosing 'Global' in the Geographic Exposure filter.

You can also check out our Fund Guidebook for more information on global funds, or if you have any further questions about global funds, email us at mutualfunds@colfinancial.com.

Conclusion

Global funds should be a key part of an investor’s whole portfolio because they offer exposure to diverse markets and sectors, reducing reliance on the performance of a single economy to diversify risk and potentially enhance returns over the long term.

To have a look at all available global funds, you may check out our Fund Guidebook to get a comprehensive list of available funds that you can invest in or email us at mutualfunds@colfinancial.com.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.