Identify a stock's trend using this technical indicator

COL Financial

Expert

Key Points

Whether you're new to trading or have been away from the stock market and are uncertain about your next move, understanding market trends is one of the first essential steps. This article simplifies how to spot these trends, helping to improve your chances of trading success.

A successful surfer is the one who best rides the wave. If we want to be successful traders in the Stock Market, we need to learn how to ride the Market’s “waves”. In our world of investing and trading, we call that the trend.

And there’s this quote saying “The trend is your friend until it bends.” It’s important to know the trend of the market if we want to maximize our profits. As in nature, if a surfer needs to know how to spot a good wave and learn to ride in order to be a successful surfer, and if a farmer needs to know what season is it and the best crops to plant and harvest to maximize yield, as traders, we need to know what trend are we in in order to make the most profits we can.

So what is a trend? There are 3 types of trend: Uptrend, Downtrend, and Sideways.

Here in the Philippine Stock Market, we make our money if prices increase, so we want to make sure we position ourselves in an uptrend and avoid downtrend or sideways movement. It’s important to remember that nobody knows what the market is going to do. Whether it’s going to move up, down, sideways or what, that’s why we just ride the trend that the market is giving us in order to increase our probability that we can generate profits for our portfolio.

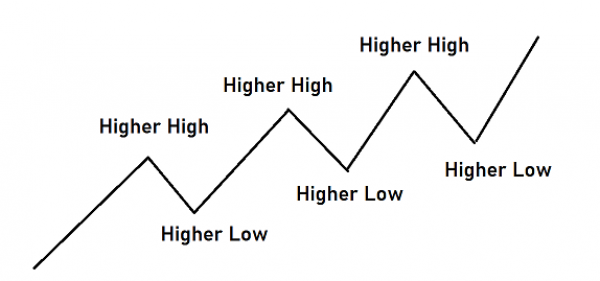

Now, how do we know what an uptrend is? By textbook definition, it’s a series of higher highs and higher lows. It looks like this.

Not only that should be the ideal price movement of the stock we’re holding, but our portfolio too!

Since trading is all about increasing our probability of making profits, how can we make sure that we’re still on an uptrend?

Introducing to you a very simple technical indicator called the “Moving Average” a moving average is basically an indicator that tells us what trend a stock is in. By textbook definition, a moving average is just the average price over x amount of time that.

To put it simply, what we want is for Price to be ABOVE the Moving Average for it to be called an uptrend.

Now going back to our surfer analogy, think of the Moving Average as the Wave and the Price as the Surfer. What we want to see is the Price hovering above the Moving Average, more like price surfing its moving average!

Notice when MER broke out its moving average last April 11, 2023 and say we bought that day and held until Price moved below March 15, 2024. More than a year’s worth of hold made us 15.5% in profit! Note that D dividends are not included in this example.

Notice how following the trend can also help us avoid losses in the market. Say if you followed our example of buying above the moving average when price broke out last August 26, 2021, selling when it broke down could have gave you 35% gain and help you avoid a -30% draw down.

Observe the violet boxes, since we’re playing a probability game, our example does not guarantee a 100% chance of making money. As you can see there are many times that price gives out signals of when to buy and sell. If you participated over those periods, you would have lost money.

That is why we call it “The Trend is our Friend until it Bends.” We just ride the wave that the Moving Average is telling us to do! Given the right context of everything that is happening, we can increase our probability of making a profit.

If you want to learn more, you can check our Technical Analysis 101 by our very own Chief Technical Analyst, Juanis Barredo https://bit.ly/COLtechnicalanalysis101

We also have different Technical Analysis research that you can read to better enhance your investing and trading plan!

You can also access this using the charting tool available in your COL account:

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.