2025 Made Easy: Investment Basics for First-Time Investors

COL Financial

Expert

Key Points

Start investing consistently in 2025 with these strategies: - Start Small, Think Big - Spread Your Investments Across Different Assets/Diversify Your Investing Portfolio - Stay on Track: Consistency is Key - Create Your Ideal Portfolio - Get Started Investing in Funds Today

Happy New Year! As we welcome 2025, it's the perfect time to set new financial goals and take action. One of the best ways to build long-term wealth and secure your financial future is through consistent investing using mutual funds and UITFs.

Start Small, Think Big

No matter where you are in your financial journey, the key to wealth-building is starting early and staying consistent. Investing regularly—through monthly contributions or lump sums—helps you ride out market fluctuations, take advantage of market growth, and harness the power of compounding.

Spread Your Investments Across Different Assets/Diversify Your Investing Portfolio

Diversification is one of the most important principles in investing. By spreading your investments across various asset classes—such as equities, bonds, real estate, and global markets—you can reduce the risk of any single investment impacting your portfolio too heavily.

Mutual funds and UITFs make it easier to achieve diversification by pooling your money with other investors to access a range of local and global assets.

• Local and Global Opportunities: Invest in the growth of both the Philippine economy and global markets. Whether you're investing in Philippine equities, U.S. tech stocks, global income-paying funds, or emerging markets, mutual funds and UITFs provide access to a wide variety of sectors, industries, and geographies.

• Risk Management: Diversification spreads risk across various investments, making your portfolio more resilient to market volatility. When one sector underperforms, other sectors or assets may compensate, reducing the overall impact on your returns.

Stay on Track: Consistency is Key

In times of market uncertainty, it’s easy to get distracted by short-term fluctuations. But consistent investing—no matter what the market is doing—helps you stay focused on your long-term goals. The best time to invest is always now. Every contribution you make, no matter how small, brings you one step closer to your financial goals.

Create Your Ideal Portfolio

Building a portfolio that aligns with your goals and risk tolerance is easier than you think. Here’s how to get started:

1. Define your goals: Are you saving for retirement, a new home, or your child’s education?

2. Assess your risk tolerance: Understanding your comfort and emotional response with market volatility helps you choose the right mix of assets.

3. Invest regularly: Automate your investments to ensure that you stay disciplined and take advantage of COL’s Easy Investment Program.

Whether you’re new to investing or have been in the market for a while, 2025 is the perfect time to make consistent investing a part of your financial strategy.

Get Started Investing in Funds Today

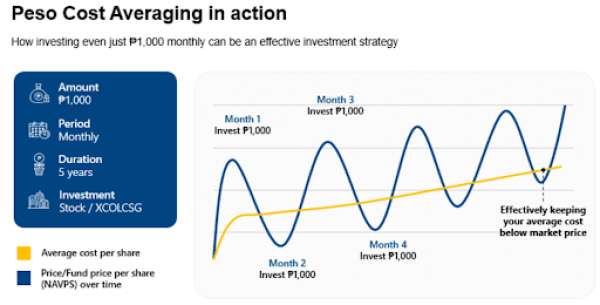

Ready to take the first step? Explore our mutual fund and UITF options and see how easy it is to start investing regularly, diversify your portfolio, and manage risk. Below is an illustration of how regular investing can help you achieve your financial goals. Start small with consistency and anchor your investments for a particular purpose.

Peso Cost Averaging (PCA) is a simple investment strategy where an investor regularly invests a fixed amount in a specific asset, such as stocks or mutual funds, regardless of market conditions.

By consistently buying more units when prices are low and fewer units when prices are high, PCA helps reduce the average cost of investments over time and minimizes the impact of market volatility.

This disciplined approach removes the stress of timing the market, encourages consistent investing, and is especially effective for long-term goals like retirement or education. While it doesn’t guarantee profits, PCA is a practical way for beginners and seasoned investors alike to steadily build wealth.

Disclaimers: This information is for reference only. Mutual Funds and UITFs are not deposit products. Securities’ prices fluctuate, and there’s a risk of losses. For the full list of disclosures, go to bit.ly/COL_disclaimers. For concerns, contact helpdesk@colfinancial.com. COL is regulated by the SEC at msrdsubmission@sec.gov.ph.

This article is part of Your Investing Journey - COL's monthly email newsletter that contains insights and strategies by the COL community to help you achieve your financial goals. Click here to read more articles like this.

COL Financial is the country’s most trusted wealth-building partner where more than 400,000 Filipinos invest in stocks and mutual funds. COL was founded on the belief that ’every Filipino deserves to be rich’. That is why, for twenty years now, we remain committed to help Filipinos build wealth by continuously providing free seminars, expert guidance and innovate tools.